Few fields hold as much weight, importance, and opportunity in the enormous universe of academic disciplines as finance. When students choose their academic routes, selecting a major is frequently a critical decision that shapes their future employment and opportunities. While the choosing process can be difficult, a degree in finance stands out as an excellent choice for a variety of reasons, including a combination of versatility, demand, intellectual challenge, and professional progress.

src: unsplash.com

src: unsplash.com

Understanding the Heart of Finance

Understanding the core of finance reveals a universe of complicated mechanics that drive the ebb and flow of economies, thereby changing the very essence of our daily lives. Finance is more than just numbers on a spreadsheet or stocks on a market ticker; it represents the pulse of social goals, threats, and possibilities.

src: unsplash.com

src: unsplash.com

At its core, it is about resource allocation—how capital travels, where it congregates, and the paths it carves in pursuit of growth and stability. It's a multidimensional tapestry fashioned from the threads of investing, risk management, and basic supply and demand fundamentals.

Understanding the essence of finance entails digging into market psychology, the complex dance of risk and reward, and the ethics that support prudent financial management. It's about understanding the complexity without losing sight of the human element—recognizing that behind every transaction is a story, a purpose, or a dream that's being pursued.

src: unsplash.com

src: unsplash.com

Furthermore, it necessitates an understanding of global economic interconnectedness—a domino effect in which actions taken in one part of the world ricochet across continents, altering livelihoods and determining destinies.

To properly understand the heart of finance, one must embrace its potential to propel progress as well as the responsibility it has in crafting a more equal and sustainable future. It is not just about profits and losses, but about creating a climate in which wealth is shared, risks are managed appropriately, and opportunities are available to all. Understanding this heart, this core, is to grasp the essential pulse of our economic existence.

src: unsplash

src: unsplash

Career Opportunities and Versatility

One of the most appealing aspects of a finance major is its versatility. The abilities gained are highly transferable across businesses, making finance graduates valuable assets in a variety of fields. Whether in banking, corporate finance, investment management, or financial consulting, the knowledge learned is priceless.

src: unsplash.com

src: unsplash.com

The ever-changing global economy necessitates skilled financial professionals. The rise of fintech, the expansion of global markets, and the increasing complexity of financial products all present opportunities for those with a good financial foundation. Opportunities abound and are diverse, ranging from financial planning to risk assessment and analysis.

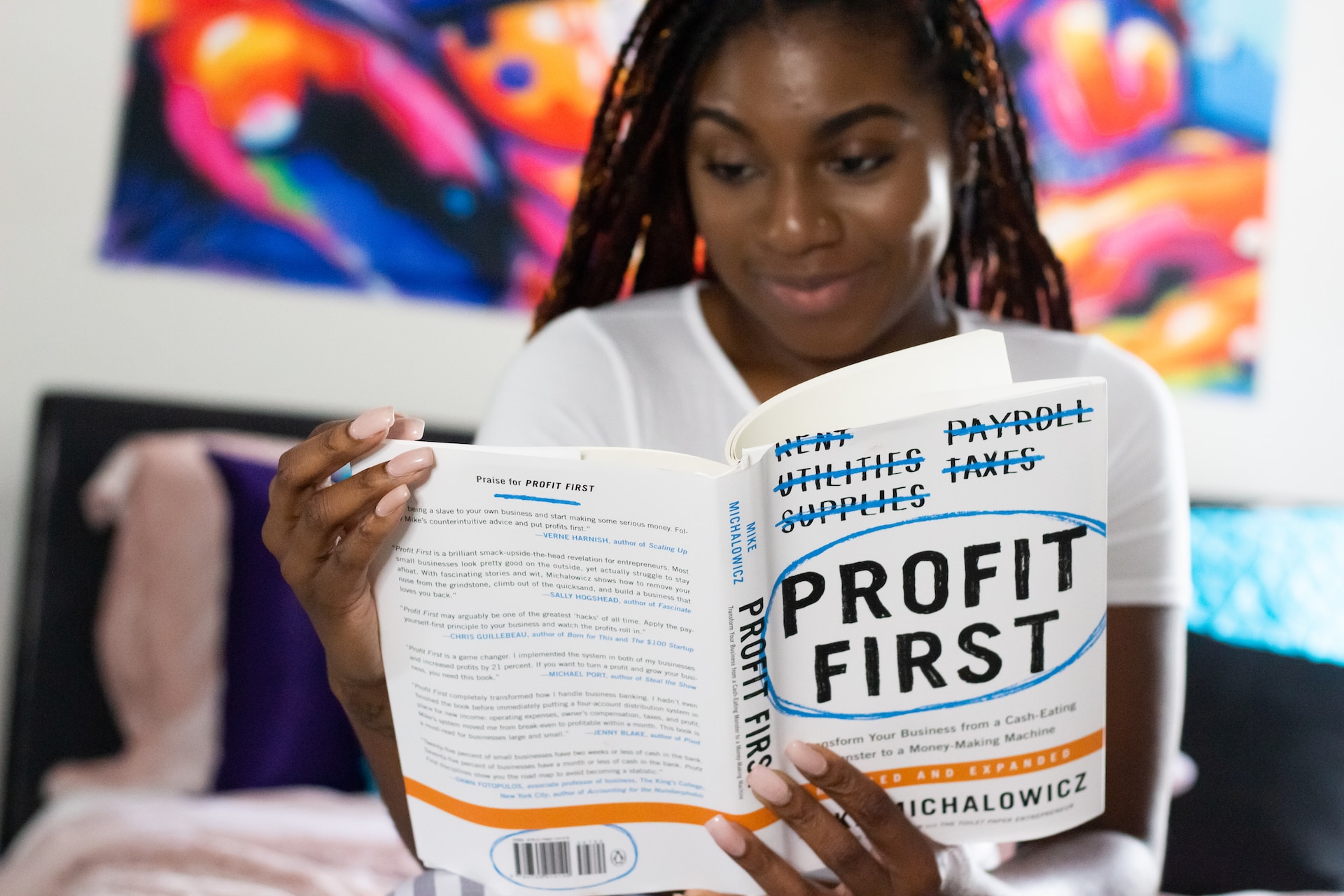

Personal Empowerment and Financial Literacy

Furthermore, a finance major provides an in-depth understanding of personal money. Graduates have the knowledge and skills to make sound decisions about investments, savings, loans, and retirement planning. This knowledge enables individuals to negotiate the intricacies of today's financial environment, safeguarding their financial futures and allowing them to make important contributions to their communities.

src: unsplash.com

src: unsplash.com

Analytical abilities and intellectual challenge

A finance major's academic rigors develop critical thinking, quantitative analysis, and problem-solving abilities. Students are challenged to apply theoretical concepts to real-world circumstances in courses like as financial modeling, portfolio management, and economic theory. This cerebral stimulation not only improves analytical skills but also fosters a mindset suited to decision-making in high-pressure situations.

Technological Integration and Adaptability

Furthermore, technological innovations are constantly being integrated into the finance industry. A finance degree covers not only traditional financial concepts, but also introduces students to emerging technologies such as blockchain, machine learning, and data analytics. This exposure guarantees that graduates are equipped with the most up-to-date tools and practices, equipping them for the ever-changing financial sector.

src: unsplash.com

src: unsplash.com

Social Impact and Influence

src: unsplash.com

src: unsplash.com

Finance has an impact that extends beyond individual careers. Financial professionals are critical in influencing economies, leading investments, and promoting growth. Graduates who understand the complicated workings of financial institutions can help to improve economic stability, promote appropriate investment practices, and support long-term financial strategy.

Developing Success Skills

Finance success entails more than just technical knowledge; it entails a set of qualities that propel individuals to excellence in this dynamic sector. Here are some critical success abilities in finance.

src: unsplash.com

src: unsplash.com

1. Understanding financial ideas, accounting principles, and market dynamics is essential. It entails the ability to understand financial documents, analyze data, and recognize economic patterns.

2. Analytical Thinking: The capacity to digest complex data, identify patterns, and draw insights is priceless. Analytical abilities aid in making educated decisions, assessing risk, and discovering business opportunities.

3. Making Critical Decisions: Financial professionals frequently confront high-pressure circumstances that necessitate strong judgment. It is critical to develop the ability to balance risks versus rewards and make strategic decisions.

4. Adaptability and Agility: Finance is a constantly changing industry; adaptability is essential for navigating changes in rules, market trends, and technological improvements. Being nimble allows professionals to quickly pivot and capitalize on new opportunities.

5.Communication Skills: It is critical to effectively communicate financial information to a wide range of stakeholders, whether through reports, presentations, or human contacts. Strong communication promotes clarity and trust.

6.Ethical Integrity: Maintaining ethical standards is a must. Integrity is the foundation of trust in the financial industry. Professionals must value honesty, transparency, and regulatory compliance.

7. Strategic planning entails creating long-term financial plans, identifying goals, and finding tactics to attain them. Forecasting, budgeting, and matching financial objectives with larger corporate goals are all part of this process.

8. Assessing, minimizing, and managing risks is critical to financial success. Professionals must comprehend various risk kinds and devise solutions to mitigate potential negative consequences.

9. Teamwork and Collaboration: Finance operates inside a professional network. It is critical to attain group goals by efficiently collaborating with coworkers, departments, or external partners.

10. Continuous Learning: The financial world is always changing. Continuous learning, whether through formal schooling, certifications, or remaining current with industry trends, is critical for long-term success.

Formal education, practical experience, mentorship, and continuing self-improvement are frequently used to develop these talents. Balancing technical expertise with interpersonal and strategic abilities is the foundation of success in the multidimensional world of finance.

src: unsplash.com

src: unsplash.com

A finance major's curriculum emphasizes quantitative analysis, which prepares students to evaluate financial data, conduct risk assessments, and make data-driven decisions. The ability to perform statistical analysis, financial modeling, and spreadsheet applications builds a solid foundation for dealing with complex financial problems.

Interpersonal and Communication Skills

Effective communication is critical in the banking industry. Finance majors are urged to enhance their communication abilities so that they can communicate complex financial information in an understandable manner. Furthermore, collaborative projects and presentations build cooperation and interpersonal skills, both of which are necessary for success in any professional situation.

Ethical Thinking and Decision Making

Ethical thinking and decision-making are critical in finance because they support trust, credibility, and long-term sustainability. Here's how ethical considerations come into play:

src: unsplash.com

src: unsplash.com

-Integrity as a Foundation: The commitment to integrity is the starting point for ethical thought. It entails making decisions and acting in accordance with moral values and professional standards, even when confronted with difficult conditions.

-Transparency and Disclosure: In finance, ethical decision-making promotes transparency. It entails providing stakeholders with accurate and thorough information so that they can make educated decisions.

-Conflicts of Interest: Financial professionals must negotiate potential conflicts of interest with integrity. They should prioritize the interests of their clients or organizations before personal benefit and declare any potential conflicts of interest up front.

-Compliance with Regulations and Laws: Making ethical decisions entails adhering to legal standards as well as industrial regulations. To maintain ethical practices, professionals must grasp and adhere to these principles.

-Fairness and equity: Ethical thinking in finance necessitates treating all stakeholders fairly. It entails preventing discrimination, ensuring equal access to opportunities, and equitable resource allocation.

Ethical decision-making applies to investment decisions, according to responsible investment practices. Environmental, social, and governance (ESG) concerns are taken into account in responsible investing, balancing financial returns with social and environmental repercussions.

-Risk Assessment and Mitigation: Ethical decision-making entails assessing risks publicly and responsibly mitigating them. It is critical to disclose potential risks to stakeholders and take steps to mitigate unfavorable consequences.

-Professional Confidentiality: Maintaining confidentiality and safeguarding sensitive information is an essential component of ethical behavior. Professionals must protect the privacy of their clients or organizations and handle information with extreme caution.

-Long-Term Sustainability: Ethical thinking in finance takes into account the long-term consequences of decisions. It entails balancing short-term benefits with financial practices' long-term viability and resilience.

-Leadership Ethics: Ethical leadership establishes the tone for an organization. Finance leaders should model ethical behavior, building a culture in which ethical decision-making is promoted and rewarded.

-Risk Assessment and Mitigation: Making ethical decisions includes publicly analyzing risks and ethically mitigating them. It is vital to inform stakeholders about potential risks and take efforts to mitigate negative repercussions.

-Maintaining professional secrecy and safeguarding sensitive information is a fundamental component of ethical behavior. Professionals must preserve their clients' or organizations' privacy and handle information with extreme caution.

-Long-Term Sustainability: Ethical decision-making in finance considers the long-term ramifications of decisions. It requires balancing short-term gains with the long-term viability and robustness of financial processes.

-Leadership Ethics: Ethical leadership sets the tone for a company. Finance leaders can provide an example of ethical behavior by creating a culture in which ethical decision-making is encouraged and rewarded.

src: unsplash.com

src: unsplash.com

A Strong Case for a Finance Major

Finally, the attractiveness of a finance degree originates from its diverse nature, which provides a mix of practical application, intellectual stimulation, professional opportunities, and societal effect. The abilities learned during a finance education transcend specific professions, allowing graduates to thrive in a variety of professional settings while making a meaningful contribution to the financial landscape.

You must be logged in to post a comment.